Critical Illness Policy Information

Disclosures and General Exclusions

Exclusions and Limitations

EXCLUSIONS AND LIMITATIONS

A SUMMARY OF PLAN LIMITATIONS AND EXCLUSIONS FOR CRITICAL

ILLNESS:

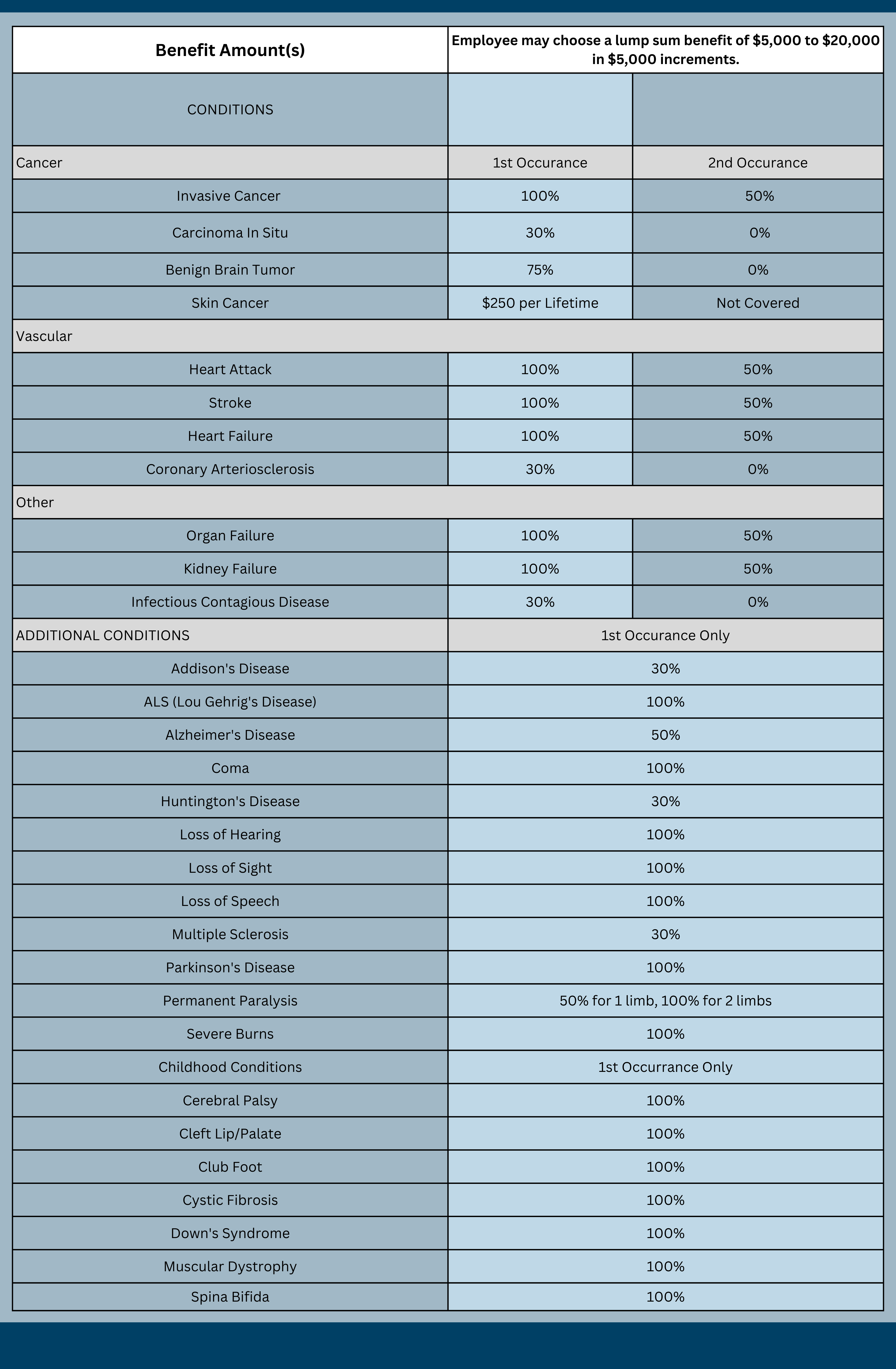

We will not pay benefits for the First Occurrence of a Critical Illness if it occurs less than 3 months after the First Occurrence of a related Critical Illness for which this Plan paid benefits. By related we mean either: (a) both Critical Illnesses are contained within the Cancer Related Conditions category; or (b) both Critical Illnesses are contained within the Vascular Conditions category.

We will not pay benefits for a Second occurrence (recurrence) of a Critical Illness unless the Covered Person has not exhibited symptoms or received care or treatment for that Critical Illness for at least 12 months in a row prior to the recurrence. For purposes of this exclusion, care or treatment does not include:

(1) preventive medications in the absence of disease; and (2) routine scheduled follow-up visits to a Doctor.

We do not pay benefits for claims relating to a covered person: taking part in any war or act of war (including service in the armed forces) committing a felony or taking part in any riot or other civil disorder or intentionally injuring themselves or attempting suicide while sane or insane.

Employees must be legally working in the United States in order to be eligible for coverage. Underwriting must approve coverage for employees on temporary assignment: (a) exceeding 1 year; or (b) in an area under travel warning by the US Department of State, subject to state specific variations.

Guardian’s Critical Illness plan does not provide comprehensive medical

coverage. It is a basic or limited benefit and is not intended to cover all medical expenses. It does not provide “basic hospital,” “basic medical,” or “ medical” insurance as defined by the New York State Insurance Department.

Health questions are required on late enrollees. This coverage will not be

effective until approved by a Guardian underwriter.

The policy has exclusions and limitations that may impact the eligibility for or entitlement to benefits under each covered condition. See your certificate booklet for a full listing of exclusions & limitations. If Critical Illness insurance premium is paid for on a pre tax basis, the benefit may be taxable. Please contact your tax or legal advisor regarding the tax treatment of your policy benefits.